Gold Futures Weekly Workbook: Harmonizing Gann Square of 9, Options Levels, and Saturn Alignment (April 28 – May 2, 2025)

Introduction

As we step into the final trading days of April, Gold Futures (GC) are positioned at a critical point. Trading around $3,308 at the Monday open, gold has surged from recent lows and now sits at the threshold of important mathematical, psychological, and cosmic barriers.

This week’s trading landscape presents a rare and powerful harmony: the convergence of Gann Square of 9 mathematical levels from the April 22nd swing high at 3509, Options Open Interest walls, and the astrological influence of Saturn’s current position at 334°.

This workbook outlines the key price levels to watch, crafted from the union of Gann theory, real-world market positioning, and cosmic timing. It will serve as a tactical guide to navigate the gold market Monday through Friday.

Big Picture Outlook

Gold has shown strong momentum in April but is now approaching major resistance zones where institutional option positioning, Gann cycle mathematics, and planetary cycles suggest heightened volatility, potential trap setups, and major inflection points.

Expect expanded daily ranges, rapid reversals near key levels, and sharp directional moves triggered by options gamma effects and harmonic time cycles.

Major Gann Square of 9 Levels (from 3509 Swing High)

Immediate Upside Levels:

- 3519 (15° up): Minor resistance

- 3531 (30° up): Secondary resistance

- 3541 (45° up): Strong resistance

- 3552 (60° up): Mid-major resistance

- 3563 (75° up): Inflection zone

- 3573 (90° up): Major resistance

- 3637 (180° up): Full secondary extension target

Immediate Downside Levels:

- 3499 (15° down): Minor support

- 3488 (30° down): Secondary support

- 3478 (45° down): Strong support

- 3466 (60° down): Mid-support

- 3455 (75° down): Inflection support

- 3446 (90° down): Major support

- 3384 (180° down): Key structural support

- 3322 (270° down): Deep cycle support

Major Options Open Interest Levels

| Level | Comment |

|---|---|

| 3300 | Massive put/call cluster — critical battlefield |

| 3250 | Strong put defense below |

| 3400 | Heavy call wall — major upside resistance |

| 3200 | Deep backup put defense |

Harmonized Key Levels (Gann + Options Confluence)

These levels are where Gann projections and real-world market positioning overlap, creating maximum energy points:

| Level | Why It Matters |

| 3322-3300 | Critical support/battlefield (Gann support + massive OI) |

| 3262-3250 | Deep secondary support (Gann cycle + put defense) |

| 3384-3400 | Major resistance/magnet zone (Gann resistance + call wall) |

| 3499-3500 | Minor psychological resistance (Gann + psychological round number) |

Saturn Alignment: Cosmic Harmony with Price

As of April 28, 2025, Saturn’s astrological position is approximately 334° longitude. In Gann astro-financial forecasting, planetary longitudes often create attractor zones for price.

Projecting Saturn’s 334° onto price, we find:

- 3340 as a harmonic projection, aligning almost perfectly with the current 3300-3340 options battlefield and Gann levels.

- This confirms 3300-3340 as an extreme magnet zone for price action this week.

If gold holds above this cosmic and mathematical attractor zone, it opens bullish potential. If it loses this zone, expect sharp downside moves.

Tactical Game Plan for the Week

Primary Bias:

- Stay bullish above 3300-3322.

- Expect resistance and possible short-term tops around 3384-3400.

- Prepare for sharp liquidation if 3300 breaks decisively.

Scenarios and Reactions:

| Scenario | My Trading Plan |

| Gold holds 3300-3322 | Look for long setups targeting 3384-3400 |

| Gold breaks 3300 | Target flush toward 3250-3262 |

| Breakout over 3400 | Potential rally continuation, but scale profits aggressively |

| Rejection at 3384-3400 | Short-term short setups back toward 3322-3300 |

Timing Windows:

- Monday-Tuesday: Likely continuation attempts and first test of 3322.

- Wednesday-Thursday: Expect volatility spikes; strong reactions at major levels.

- Friday: Possible profit-taking and final week reversal setups.

Final Cheat Sheet

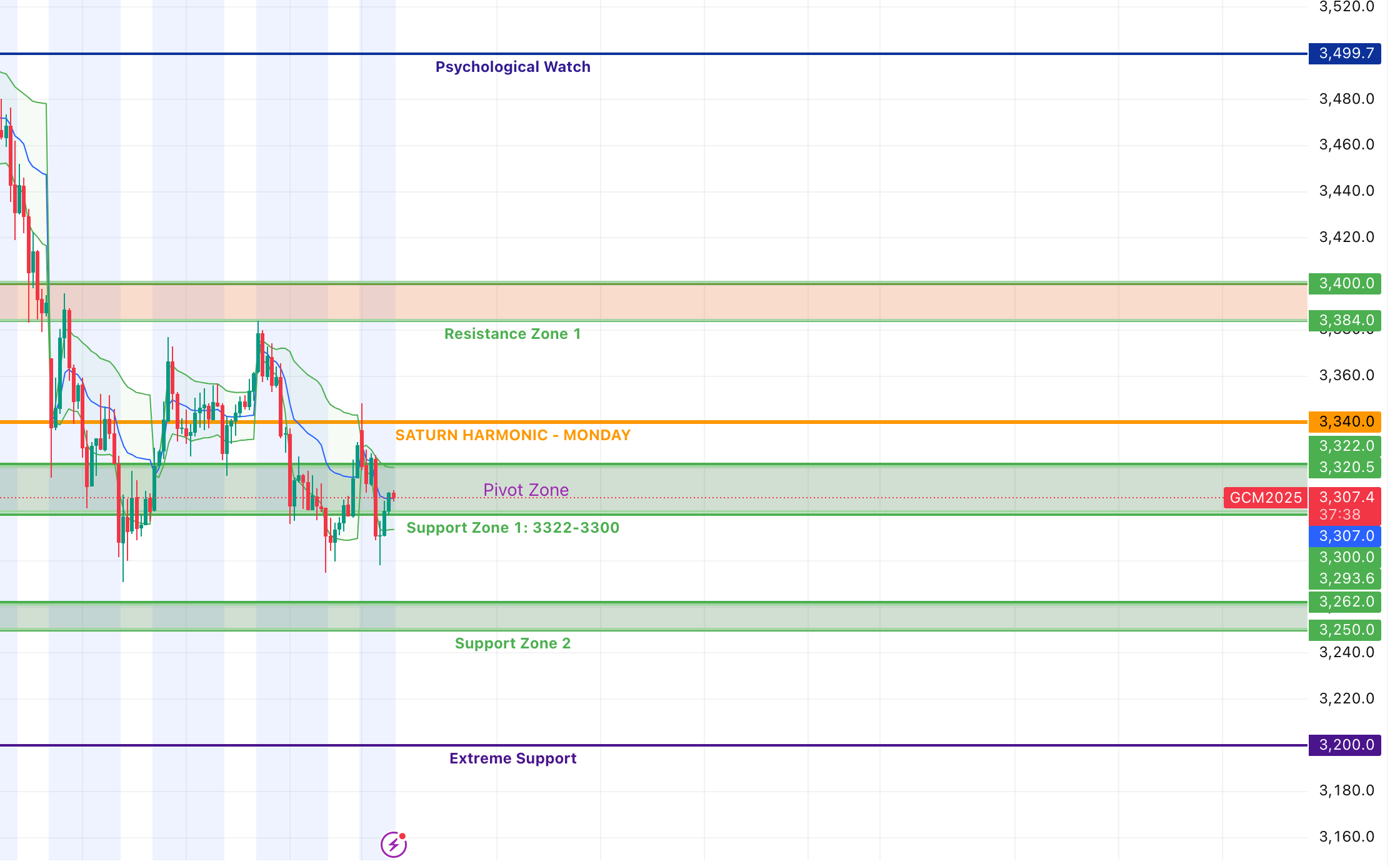

Support Zone 1: 3322-3300 (Options + Gann)

Saturn Harmonic: 3340

Support Zone 2: 3262-3250

Resistance Zone 1: 3384-3400

Psychological Watch: 3499-3500

Extreme Scenario: 3200 (deep flush support)Closing Personal Forecast

The alignment of Gann Square of 9 projections, heavy open interest, and Saturn’s cosmic positioning creates an extraordinary “harmony of pressure” in the gold market this week.

Whichever side gains control around 3300-3340 will likely dictate the trend for the next two weeks.